Organization of Association

The Oregon Planned Community Act (PCA) and the Oregon Condominium Act (OCA) require that an association of owners be formed for the purpose of administrating, managing, and operating the development. The PCA specifically requires the declarant to organize the association as a nonprofit corporation under the Oregon Nonprofit Corporation Act (See ORS chapter 65) and adopt and record the initial bylaws not later than the date on which the first lot is conveyed. With respect to a condominium, upon the recording of the declaration and bylaws, an unincorporated association is created by operation of law. Typically, the governing documents require the declarant to incorporate the association as a nonprofit corporation under ORS Chapter 65 prior to the conveyance of the first unit or by the turnover meeting discussed below.

Declarant Rights Relating to Control of Association.

Subject to certain statutory limitations, a declaration may provide for a period of declarant control of the association. A declarant’s control of an association may include the authority to appoint and remove officers and members of the board of directors of the association, to exercise powers and responsibilities otherwise assigned by the declaration and bylaws to the association, to approve amendments to the declaration or bylaws and, to allocate a greater number of votes to lots or units owned by the declarant. However, even though a declarant may initially control an association, the association itself is a separate entity.

Transition from Developer Control to Control by Owners

Transition is frequently characterized as a process and not an event. This concept is reflected in the PCA and OCA, both of which require the formation of a transitional advisory committee. This committee provides for the transition from administrative control by the declarant to administrative control by the association and its board and is generally referred to as a “turnover.” The timetable and procedure for turnover is established by the PCA or OCA and the declaration. A smooth transition, one that is well organized and amicable, will minimize conflicts and be in the best interests of all involved parties. A successful transition significantly contributes to the success of a development.

Transitional Advisory Committee

As mentioned, the PCA and the OCA provide for the formation of a transitional advisory committee to facilitate the transition from the administrative control by the declarant to control by the association. For condominiums, the formation of a transitional advisory committee is only required if the condominium consists of at least 20 units or, if it is a staged or flexible condominium, the number of units that may annexed or created totals 20. For a planned community created on and after January 1, 2002, a transitional advisory committee is only required for Class I Planned Communities. A transitional advisory committee is advisory only. However, it can request access to the information, documents and records that the declarant must deliver to the owners at the turnover meeting. Serving on the committee provides owners an opportunity to become familiar with the governing documents, budgets, architectural and other restrictions, rules and other critical aspects of association operation and management. Members of the advisory committee are often those owners who ultimately run for, and are elected to, board positions at the turnover meeting.

Turnover Process

Turnover marks the time when legal control of an association is transferred from the declarant to the owners. However, a developer who retains a majority of the units may still practically control the association.

Calling of the Turnover Meeting

The PCA and OCA require the declarant to call the turnover meeting within 90 days of the expiration of any declarant control specified in the declaration. If no such control has been reserved in the declaration, the PCA and OCA specify a time by which such meeting must be called. The declarant must give notice of the turnover meeting in accordance with the bylaws and PCA or OCA. If the turnover meeting is not called by the declarant within the time specified, for a condominium, the meeting may be called and notice given by an owner. In the case of a planned community, the meeting may be called and notice given by an owner or the transitional advisory committee.

Turnover Meeting

At the turnover meeting, owners elect a board of directors and the declarant has the obligation to deliver all property of the owners and association held or controlled by the declarant, as well as all items specified in the PCA and OCA. This includes the association’s governing documents and financial records. Turnover is a critical time in the life of an association. It is therefore important that the association consider retaining the assistance of an attorney experienced in HOA law to ensure a smooth transition and enable the new board to function in a manner that is consistent with all applicable laws and meets the needs of the development.

Three-Month Period After Turnover Meeting.

To facilitate an orderly transition, during the three-month period following the turnover meeting, the declarant, or an informed representative, is required to be available to meet with the board of directors on at least three mutually acceptable dates to review the documents delivered at the turnover meeting.

Review of Financial Statement

For communities with annual total assessments of more than $75,000, the PCA and OCA require the financial statement of to be reviewed in accordance with statements on Standards for Accounting and Review Services issued by the American Institute of Certified Public Accountants.

Audit of Association Affairs

After the turnover meeting, the owner-elected board of directors should conduct an audit of the affairs of the association. The board will ultimately need to decide the breadth and scope of the audit. However, consideration should, at a minimum, include a review of the following:

(1) Property Inspection. An inspection of the physical components of the association’s property is critical. In conjunction with such inspection, the following are recommended:

(a) An inspection of and written report regarding the physical condition of the development by someone with experience to recognize faulty workmanship, shoddy maintenance and construction defects.

(b) A written report by an engineer or other qualified person to determine if plans and specifications were followed in construction of the development.

(c) Determination of the status of any unfinished construction repairs.

(2) Association Status. The declaration and bylaws govern matters relating to the operation of the association, including whether it must be incorporated. Unless the declarant provided a copy of the articles of incorporation at the turnover meeting, the board of directors must review the governing documents and determine whether the association is required to be incorporated. If so, after confirming with the Corporation Division in the office of the Oregon Secretary of State, the board should cause the articles of incorporation to be drafted and filed in accordance with Oregon law.

(3) Association Records. As noted above, the PCA and the OCA require that the declarant deliver to the association at the turnover meeting specific documents and items. If not provided by the declarant, the board should specifically request:

-An original or photocopy of the recorded declaration and copies of the bylaws and articles of incorporation;

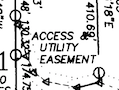

-A deed to the common property, unless contained within the declaration;

-The recorded minutes of the association and board of directors;

-All rules and regulations adopted by the declarant;

-Financial statements;

-Any and all records of association funds and accounts;

-Any and all tangible personal property of the association and an inventory of such property;

-Records of all property tax payments to be administered by the association;

-Copies of all income tax returns filed by declarant in the name of the association;

-Any and all bank signature cards;

-Reserve account and reserve study information;

(4) Assessment Collections Audit. There should be a complete analysis and evaluation of the collection process and the adequacy of the reserves fund. If there are a significant number of past due assessments, immediate action should be considered. Even if there are only a few assessments that are past due, it is recommended that if there is a transition committee, that it have a collection resolution drafted and ready for adoption by the owner-elected board of directors to facilitate the collection process. A professional reserve study may be needed to help properly fund this account.