Creating a Homeowners Association in Oregon

Many older subdivisions have recorded CC&Rs but no homeowners association to govern the community. Who enforces the provisions of the CC&Rs? Who maintains the common areas? Who ensures compliance with the architectural requirements? As a practical matter, it often makes sense to have an HOA handle these issues, rather than an individual owner or group of owners.

The Oregon Planned Community Act (ORS Chapter 94) contains a process for owners to use to form an HOA. The procedure applies to pre-2002 communities with shared maintenance responsibilities (private roads, perimeter fence, entrance monument) and with CC&Rs that require owners to pay assessments.

The process is started when at least 10% of the lot owners initiate the process. Once that happens, here are the following steps:

Notice of an organizational meeting is sent to all lot owners in the community.

The notice must include the names of the individuals initiating the process, a statement that the purpose of the meeting is to form an HOA, and a copy of the proposed articles of incorporation.

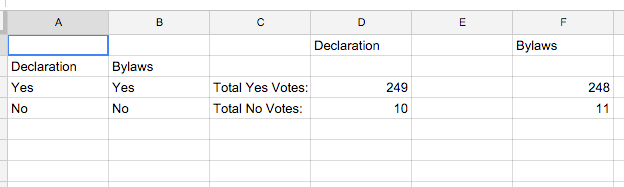

In addition, the notice must state the required number of votes necessary to form the HOA. If the existing CC&Rs are silent, then at least a majority of the lot owners must vote to create the HOA.

Lastly, the notice must state that the owners will vote to elect a board of directors to govern the new HOA.

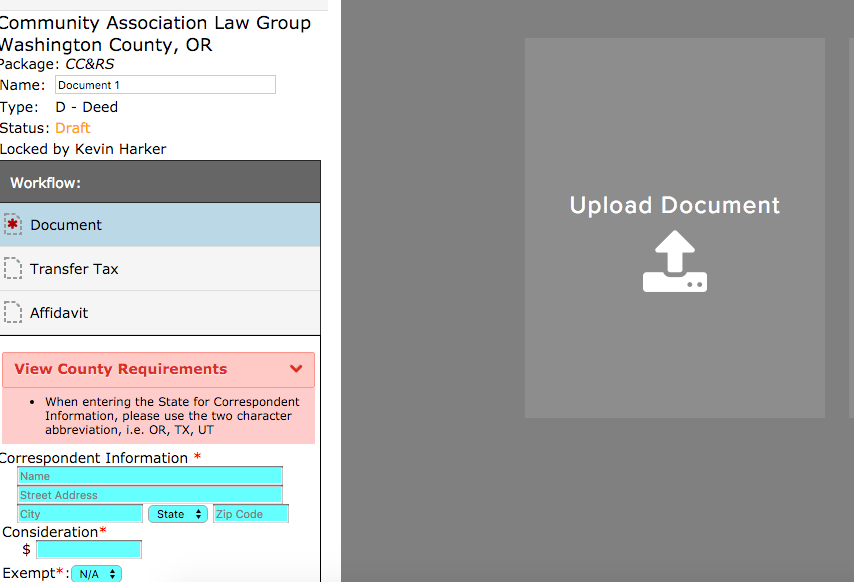

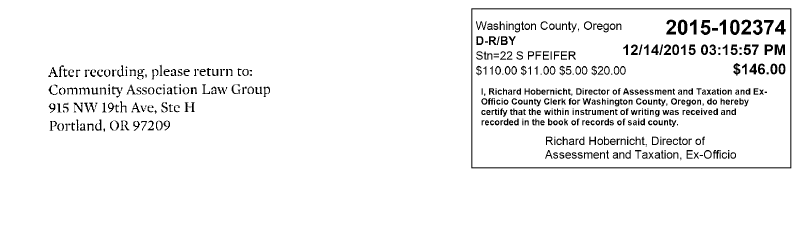

At the organizational meeting, a new board of directors is elected. The new board is then required to file the articles of incorporation and record any required documents in the county recording office.

Assuming the owners vote to form the HOA, all of the organizational expenses are a common expense shared by all owners. Now, this is a simplified version of the process. The statute governing the process (ORS 94.574) is a bit more complex, and you should consult a qualified attorney before embarking on the formation of a homeowners association.

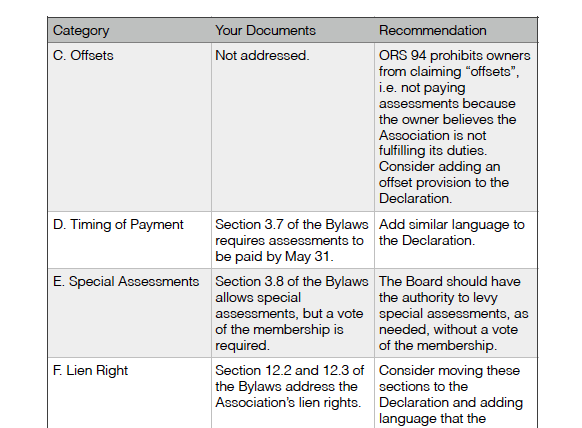

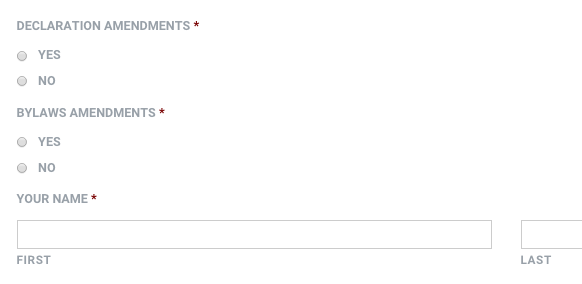

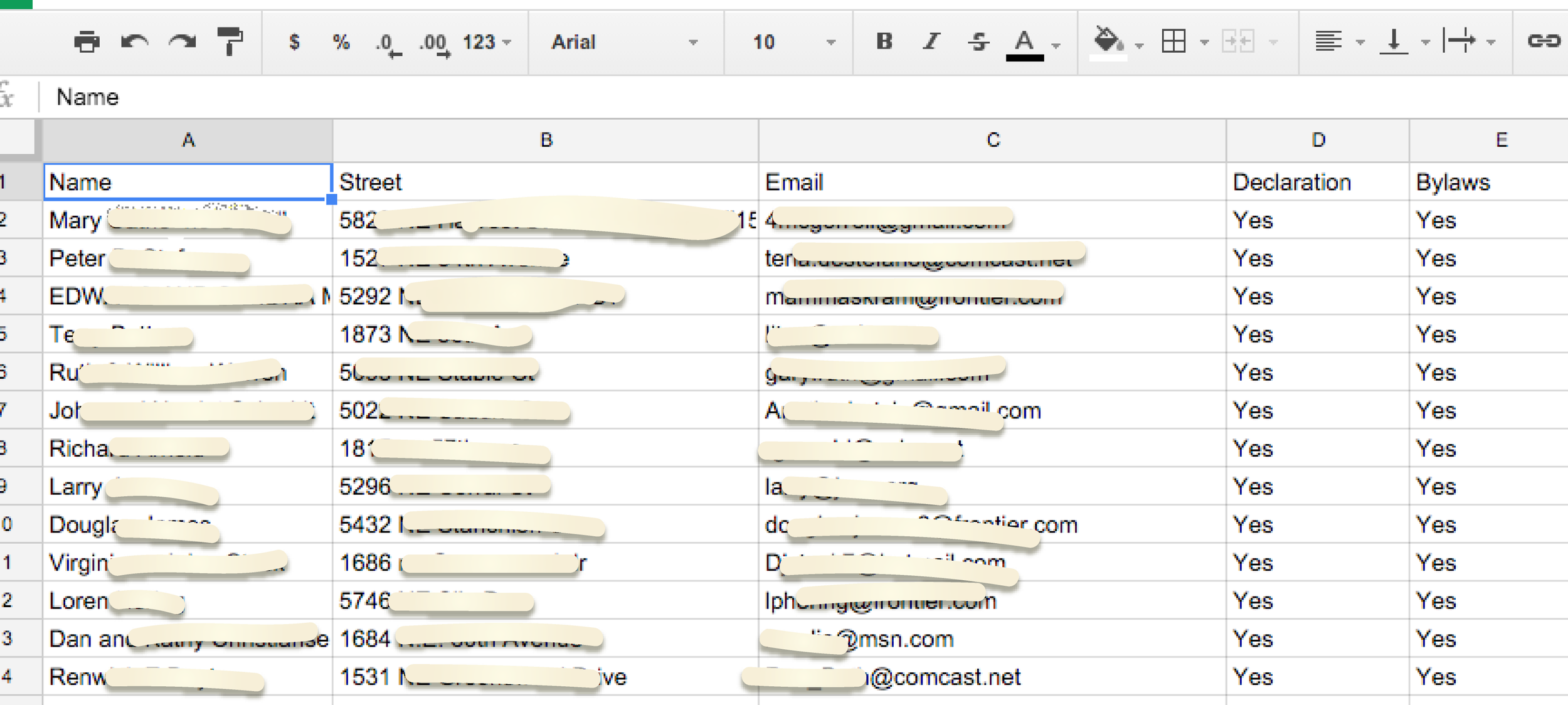

But what if the subdivision has recorded CC&Rs but no shared maintenance obligations or payment of dues? In that case, the owners must amend the CC&Rs to form an HOA. The CC&R amendment would add provisions creating the HOA and authorizing the election of a board of directors. The required vote may be high. Some CC&Rs required the approval of at least 90% of all owners. In that case, it’s critical that owners understand the benefit and value of forming an HOA.

Once the amendment is approved and recorded, the owners should incorporate as a nonprofit and file articles of incorporation with the Oregon Secretary of State. In addition, the owners should adopt bylaws. The bylaws are the operational guidelines for the new HOA and the board of directors, and should be recorded in the county recording office.

The process to form an HOA can be complicated, and as always, you are encouraged to seek competent legal advice.